In today’s digital landscape, protecting sensitive cardholder data is paramount. Payment Card Industry (PCI) Compliance plays a crucial role in safeguarding this data and maintaining the integrity of the digital payment ecosystem. As a business owner, IT manager, security professional, or compliance officer, it is essential to understand the intricacies of PCI DSS requirements, regardless of the size of your organization.

What is PCI Compliance?

PCI Compliance refers to the adherence to a set of security standards (six total) established by the Payment Card Industry Security Standards Council (PCI SSC). The standards have requirements that when properly addressed with acceptable control(s), ensure the secure handling, processing, and storage of cardholder data. The PCI DSS evolves to address the ever-changing threats and vulnerabilities in the digital payment landscape.

What Does PCI Compliance Stand For?

PCI Compliance stands for Payment Card Industry Compliance. It is mandated and governed by the Payment Card Industry Security Standards Council (PCI SSC), an independent body formed by major credit card companies such as Visa, Mastercard, American Express, Discover, and JCB.

Why Is PCI Compliance Important?

Non-compliance with PCI DSS can have severe consequences for businesses. Data breaches resulting from inadequate security measures can lead to substantial fines, legal liabilities, and irreparable damage to a company’s reputation. On the other hand, being PCI compliant demonstrates a commitment to data security, enhances customer trust, and helps prevent costly data breaches.

Acumera Offers Solution to Ensure Compliance with PCI DSS 4.0 Deadline

How a Payment Processing Software Can Help Your Firm Become PCI Compliant

The use of robust payment processing software can significantly simplify the path to PCI compliance. Look for software solutions that offer tokenization, point-to-point encryption (P2PE), and secure payment gateways. These features help protect sensitive data and reduce the scope of PCI DSS requirements for your business.

What Are Examples of PCI Compliance Data Breaches?

Notable examples of PCI compliance data breaches include the Target data breach in 2013, which affected over 40 million credit and debit card accounts, and the Home Depot data breach in 2014, which compromised approximately 56 million payment cards. These incidents highlight the importance of maintaining strict PCI compliance measures to avoid similar consequences.

Is PCI Compliance Legally Required?

While PCI compliance is not mandated by federal law, it is a contractual obligation for businesses that accept credit card payments. Failure to comply with PCI DSS requirements can result in substantial penalties imposed by credit card companies and acquiring banks.

Do I Need to Comply With PCI DSS?

Merchants and service providers who transmit, process, or store cardholder data must comply with PCI DSS, regardless of their size or transaction volume.

Requirements of PCI DSS Compliance – The Complete Checklist

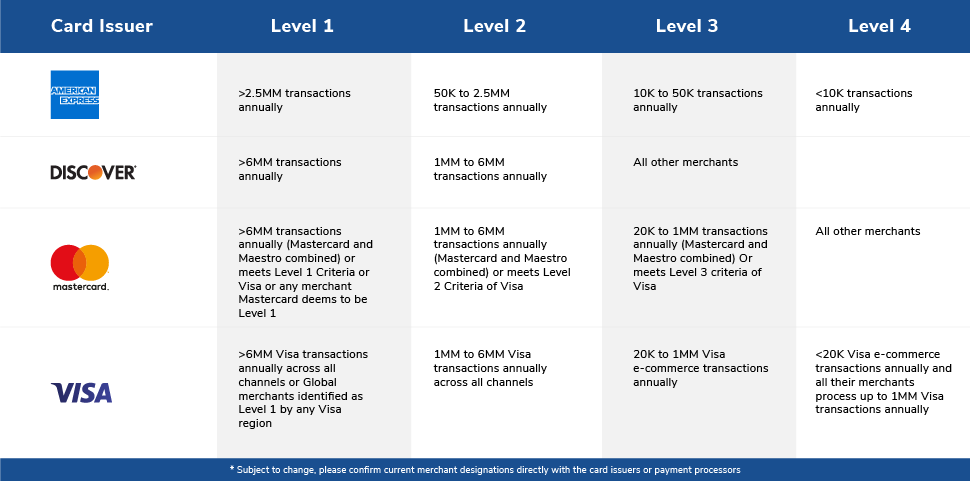

PCI Compliance Levels

PCI DSS compliance is categorized into four levels based on the annual volume of credit card transactions processed by a business:

As a PCI-compliant, level 1 service provider, Acumera understands the stringent requirements and provides solutions to help businesses achieve and maintain compliance.

Implementing PCI DSS Controls: A Deep Dive

To achieve PCI DSS compliance, businesses must implement a series of controls to satisfy each requirement, including:

Build and Maintain Secure Network and Systems:

In the past, theft of financial records required a criminal to enter an entity’s physical business site. Now payment transactions occur with electronic devices, including traditional payment terminals, mobile devices, and other Internet-connected computer systems. By using network security controls, entities can prevent criminals from virtually accessing payment system networks and stealing stored cardholder data.

Install and Maintain Network Security Controls (Requirement 1)

Network security controls (NSCs), such as firewalls and other network security technologies, are network policy enforcement points that typically control network traffic between two or more logical or physical network segments (or subnets) based on predefined policies or rules. Traditionally this function has been provided by physical firewalls; however, this functionality is now typically provided by virtual devices, cloud access controls, virtualization/container systems, and other software-defined networking technology.

1.1 Processes and mechanisms for installing and maintaining network security controls are defined and understood.

1.2 Network security controls (NSCs) are configured and maintained.

1.3 Network access to and from the cardholder data environment is restricted.

1.4 Network connections between trusted and untrusted networks are controlled.

1.5 Risks to the CDE from computing devices that are able to connect to both untrusted networks and the CDE are mitigated.

Apply Secure Configurations to all System Components (Requirement 2)

Malicious individuals, both external and internal to an entity, often use default passwords and other vendor default settings to compromise systems. These passwords and settings are well-known and are easily determined via public information. Applying secure configurations to system components reduces the means available to an attacker to compromise systems. Changing default passwords, removing unnecessary software, functions, and accounts, and disabling or removing unnecessary services all help to reduce the potential attack surface.

2.1 Processes and mechanisms for applying secure configurations to all system components are defined and understood.

2.2 System components are configured and managed securely.

2.3 Wireless environments are configured and managed securely.

Protect Account Data:

Payment account data refers to any information printed, processed, transmitted, or stored in any form on a payment card. Account data refers to both cardholder data and sensitive authentication data, and protection of the account data is required where account data is stored, processed, or transmitted. Entities accepting payment cards are expected to protect account data and to prevent its unauthorized use – whether the data is printed or stored locally, or transmitted over an internal or public network to a remote server or service provider.

Protect Stored Account Data (Requirement 3)

Payment account data should not be stored unless it is necessary to meet the needs of the business. Sensitive authentication data must never be stored after authorization. If your organization stores Primary Account Number(s) (PAN), it is crucial to render it unreadable. If your company stores sensitive authentication data prior to completion of authorization, that data must also be protected.

3.1 Processes and mechanisms for protecting stored account data are defined and understood.

3.2 Storage of account data is kept to a minimum.

3.3 Sensitive authentication data (SAD) is not stored after authorization.

3.4 Access to displays of full PAN and ability to copy cardholder data are restricted.

3.5 Primary Account Number is secured wherever it is stored.

3.6 Cryptographic keys used to protect stored account data are secured.

3.7 Where cryptography is used to protect stored account data, key management processes and procedures covering all aspects of the key lifecycle are defined and implemented.

Protect Cardholder Data With Strong Cryptography During Transmission Over Open, Public Networks (Requirement 4)

To protect against compromise, primary account numbers (PANs) must be encrypted during transmission over networks that are easily accessed by malicious individuals, including untrusted and public networks. Misconfigured wireless networks and vulnerabilities in legacy encryption and authentication protocols continue to be targeted by malicious individuals aiming to exploit these vulnerabilities to gain privileged access to cardholder data environments (CDE). PAN transmissions can be protected by encrypting the data before it is transmitted, or by encrypting the session over which the data is transmitted, or both.

4.1 Processes and mechanisms for protecting cardholder data with strong cryptography during transmission over open, public networks are defined and documented.

4.2 PAN is protected with strong cryptography during transmission.

This requirement is a best practice until 31 March 2025, after which it must be fully considered as part of a PCI DSS assessment.

Maintain a Vulnerability Management Program:

Vulnerability management is the process of systematically and continuously finding and mitigating weaknesses in an entity’s payment card environment. This includes addressing threats from malicious software, routinely identifying and patching vulnerabilities, and ensuring that software is developed securely and without known coding vulnerabilities.

Protect All Systems and Networks From Malicious Software (Requirement 5)

Malicious software (malware) is software or firmware designed to infiltrate or damage a computer system without the owner’s knowledge or consent, with the intent of compromising the confidentiality, integrity, or availability of the owner’s data, applications, or operating system. Examples include viruses, worms, Trojans, spyware, ransomware, keyloggers, rootkits, malicious code, scripts, and links. Malware can enter the network during many business-approved activities, including employee email (for example, via phishing) and use of the internet, mobile computers, and storage devices, resulting in the exploitation of system vulnerabilities.

5.1 Processes and mechanisms for protecting all systems and networks from malicious software are defined and understood.

5.2 Malicious software (malware) is prevented, or detected and addressed.

5.3 Anti-malware mechanisms and processes are active, maintained, and monitored.

5.4 Anti-phishing mechanisms protect users against phishing attacks.

Develop and Maintain Secure Systems and Software (Requirement 6)

Security vulnerabilities in systems and applications may allow criminals to access payment data. Many of these vulnerabilities are eliminated by installing vendor-provided security patches, which perform a quick-repair job for a specific piece of programming code. All system components must have the most recently released critical security patches installed to prevent exploitation. Entities must also apply patches to less-critical systems in an appropriate time frame, based on a formal risk analysis. Applications must be developed according to secure development and coding practices, and changes to systems in the cardholder data environment must follow change control procedures.

6.1 Processes and mechanisms for developing and maintaining secure systems and software are defined and understood.

6.2 Bespoke and custom software are developed securely.

6.3 Security vulnerabilities are identified and addressed.

6.4 Public-facing web applications are protected against attacks.

6.5 Changes to all system components are managed securely.

Implement Strong Access Control Measures:

Access to payment account data must be granted only on a business need-to-know basis. Logical access controls are technical means used to permit or deny access to data on computer systems.

Physical access controls entail the use of locks or other physical means to restrict access to computer media, paper-based records, and computer systems.

Restrict Access to Cardholder Data by Business Need-to-Know (Requirement 7)

Unauthorized individuals may gain access to critical data or systems due to ineffective access control rules and definitions. To ensure critical data can only be accessed by authorized personnel, systems and processes must be in place to limit access based on need to know and according to job responsibilities. “Need to know” refers to providing access to only the least amount of data needed to perform a job. “Least privileges” refers to providing only the minimum level of privileges needed to perform a job.

7.1 Processes and mechanisms for restricting access to system components and cardholder data by business need to know are defined and understood

7.2 Access to system components and data is appropriately defined and assigned.

7.3 Access to system components and data is managed via an access control system(s).

Identify Users and Authenticate Access to System Components (Requirement 8)

Assigning a unique identification (ID) to each person with access ensures that actions taken on critical data and systems are performed by, and can be traced to, known and authorized users. Unless otherwise stated in the requirement, these requirements apply to all accounts, including point-of-sale accounts, those with administrative capabilities, and all accounts used to view or access payment account data or systems with those data. These requirements do not apply to accounts used by consumers (cardholders).

8.1 Processes and mechanisms for identifying users and authenticating access to system components are defined and understood.

8.2 User identification and related accounts for users and administrators are strictly managed throughout an account’s lifecycle.

8.3 Strong authentication for users and administrators is established and managed.

8.4 Multi-factor authentication (MFA) is implemented to secure access into the CDE.

8.5 Multi-factor authentication (MFA) systems are configured to prevent misuse.

8.6 Use of application and system accounts and associated authentication factors is strictly managed.

Granting secure, PCI-compliant remote access to network devices for authorized employees and service providers is another essential aspect of PCI DSS compliance.

Restrict Physical Access to Cardholder Data (Requirement 9)

Physical access to cardholder data or systems that store, process, or transmit cardholder data should be restricted so that unauthorized individuals cannot access or remove systems or hardcopies containing this data.

9.1 Processes and mechanisms for restricting physical access to cardholder data are defined and understood.

9.2 Physical access controls manage entry into facilities and systems containing cardholder data.

9.3 Physical access for personnel and visitors is authorized and managed.

9.4 Media with cardholder data is securely stored, accessed, distributed, and destroyed.

9.5 Point-of-interaction (POI) devices are protected from tampering and unauthorized substitution.

Regularly Monitor and Test Networks:

Physical, virtual, and wireless networks are the glue connecting all endpoints and servers in the payment infrastructure. Vulnerabilities in network devices and systems present opportunities for criminals to gain unauthorized access to payment applications and payment account data. To prevent exploitation, entities must regularly monitor and test networks to find and address unexpected access and activities, security system failures, and vulnerabilities.

Log and Monitor All Access to System Components and Cardholder Data (Requirement 10)

Logging mechanisms and the ability to track user activities are critical for detection of anomalies and suspicious activities and for effective forensic analysis. The presence of logs in all environments allows thorough tracking and analysis if something goes wrong. Determining the cause of a compromise is difficult, if not impossible, without system activity logs.

10.1 Processes and mechanisms for logging and monitoring all access to system components and cardholder data are defined and documented.

10.2 Audit logs are implemented to support the detection of anomalies and suspicious activity, and the forensic analysis of events.

10.3 Audit logs are protected from destruction and unauthorized modifications.

10.4 Audit logs are reviewed to identify anomalies or suspicious activity.

10.5 Audit log history is retained and available for analysis.

10.6 Time-synchronization mechanisms support consistent time settings across all systems.

10.7 Failures of critical security control systems are detected, reported, and responded to promptly.

Test security of systems and networks regularly (Requirement 11)

Vulnerabilities are being discovered continually by malicious individuals and researchers, and being introduced by new software. System components, processes, and bespoke and custom software should be tested frequently to ensure security controls continue to reflect a changing environment.

11.1 Processes and mechanisms for regularly testing the security of systems and networks are defined and understood.

11.2 Wireless access points are identified and monitored, and unauthorized wireless access points are addressed.

11.3 External and internal vulnerabilities are regularly identified, prioritized, and addressed.

11.4 External and internal penetration testing is regularly performed, and exploitable vulnerabilities and security weaknesses are corrected.

11.5 Network intrusions and unexpected file changes are detected and responded to.

11.6 Unauthorized changes on payment pages are detected and responded to.

Maintain an Information Security Policy:

A strong security policy sets the tone for security affecting an entity’s entire company, and it informs employees of their expected duties related to security. All employees should be aware of the sensitivity of payment account data and their responsibilities for protecting it.

Support Information Security with Organizational Policies and Programs (Requirement 12)

12.1 A comprehensive information security policy that governs and provides direction for protection of the entity’s information assets is known and current.

12.2 Acceptable use policies for end-user technologies are defined and implemented.

12.3 Risks to the cardholder data environment are formally identified, evaluated, and managed.

12.4 PCI DSS compliance is managed.

12.5 PCI DSS scope is documented and validated.

12.6 Security awareness education is an ongoing activity.

12.7 Personnel are screened to reduce risks from insider threats.

12.8 Risk to information assets associated with third-party service provider (TPSP) relationships is managed.

12.9 Third-party service providers (TPSPs) support their customers’ PCI DSS compliance.

12.10 Suspected and confirmed security incidents that could impact the CDE are responded to immediately.

More information on the PCI DSS

How PCI DSS Services from Acumera Can Help Your Business

Acumera offers comprehensive PCI DSS compliance management services to help businesses navigate the complexities of achieving and maintaining compliance. Our solutions include:

- Self-Assessment Questionnaire support to guide you through the SAQ process

- PCI DSS compliance portal for centralized management of compliance activities

- Internal and external vulnerability scanning to identify and address security weaknesses

- Threat detection, incident response, and log review services to safeguard your environment and cardholder data

- Secure remote access, with AcuLink™ Remote Access Service, ensures simple, fast, and PCI-compliant connections between AcuVigil™ and local devices and provides a layer of security

- Web filtering

- 24×7 Customer Support from a team of experts that monitor and manage customer networks

- Network device inventory and network diagrams

- PCI Attestation of Compliance (AoC) for all retailers

- Data breach financial protection to reduce the financial risk associated with security incidents

To learn more about how Acumera can help your business achieve and maintain PCI DSS compliance, request a demo today.