PCI DSS 4.0 Compliance Management

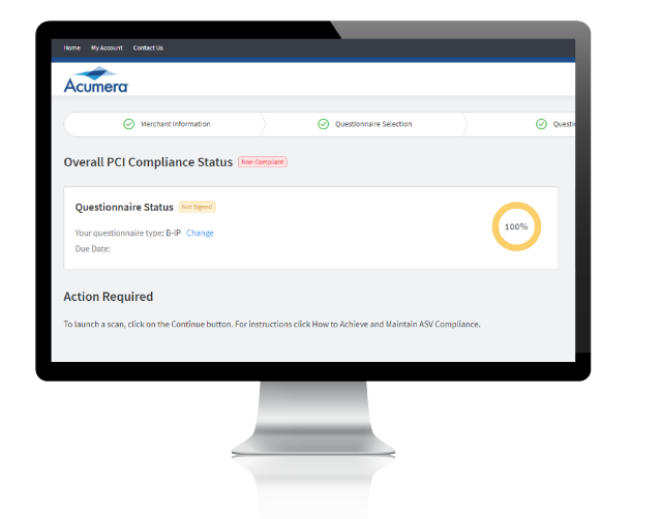

Managing PCI DSS compliance for multi-location businesses and Point-of-Sale (POS) locations is particularly challenging and time consuming. Acumera conveniently bundles Payment Card Industry Data Security Standards (PCI DSS) compliance tools and support to streamline workflow and to ultimately enhance protection against advanced threats. With years of experience assisting organizations since the inception of PCI DSS compliance, we ensure your peace of mind and security.

KEY FEATURES

PCI DSS 4.0 Compliance Management

PCI readiness services from Acumera is designed to assist companies with achieving and maintaining PCI 4.0 compliance. Acumera offers a full suite of tools and expert support to streamline compliance management, and free up your time and resources to concentrate on driving your business forward.

PCI DSS Compliance Portal

Acumera provides everything you need, from the SAQ assistance portal to the status of your vulnerability scans, in one PCI DSS compliance management portal

SAQ Support

The Self-Assessment Questionnaire (SAQ) for PCI DSS is an arduous task for retailers. The SAQ Portal Acumera provides, guides you to the correct SAQ version and paperwork process

Data Breach Financial Protection

Reduce your financial risk associated with a data security incident by providing coverage for forensic investigations, card brand fines, and consumer notification expenses

Internal Vulnerability Scanning

Our internal network vulnerability management initiates a scan of your internal network to address PCI DSS requirements

External Vulnerability Scanning

External scans identify security weaknesses in your network that an adversary could exploit and lead to a breach or network outages

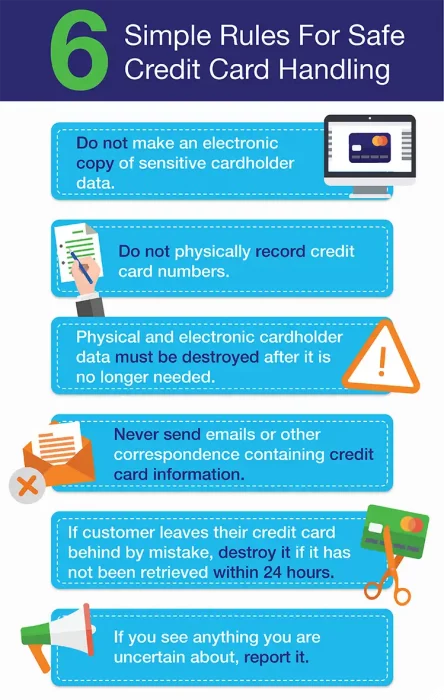

Safe Credit Card Handling

Credit card data breaches have unfortunately become common occurrences for many restaurants, retail, and other businesses that accept credit card or digital payments. So much so, that breaches hardly make the news these days, which might lead some to believe the danger has been reduced.

Regrettably, numerous electronic threats and physical security issues are still present in restaurant and retail establishments. We want to provide knowledge that organizations can utilize in protecting themselves from credit card theft.

As we rapidly migrate toward a cashless society consumers expect and deserve to feel safe and secure when presenting credit cards during transactions. Read below for our Six Simple Rules For Safe Credit Card Handling to ensure you and your business are prepared.

Never make an electronic copy of sensitive cardholder data

Train employees to understand and deny the use of any unauthorized external device, such as a “skimmer”, used to record credit card information. Criminals have been known to be brazen enough to approach employees requesting to install devices in order to record credit card information.

A majority of the time, it is the employee that is caught and prosecuted, not the criminal. It may seem like easy money; however, it can easily mean jail time for the employee involved.

Do not physically record credit card numbers

At times, companies may choose to keep credit card data for means of convenience. This practice, however efficient it may seem, is not safe.

Cardholder information must be kept in a locked drawer, with very limited access to the data. Once you factor this security in, many businesses realize that collecting data during each individual purchase is a more efficient method while also holding less risk for the business.

Physical and electronic cardholder data must be destroyed after it is no longer needed.

If you don’t need it, destroy it, and do so properly.

Destroy all physical credit card data when it no longer serves a practical purpose. Acumera’s Credit Card Handling video details several methods to properly dispose of physical credit card data.

Never send emails or other correspondence containing credit card information

Do not send sensitive credit card or banking information via email. Period.

As an aside, ensure that employees are trained to understand that your company will never request individual cardholder data under any circumstances. Any attempts to request such information should be notified to a manager immediately.

If a customer leaves their credit card behind by mistake, destroy it if it has not been retrieved within 24 hours

Sometimes we are forgetful. If a customer mistakenly leaves their card in your establishment, contact them the same day to inform them your business is in possession of the card and that it will be destroyed if not properly claimed within a specific amount of time.

We advise no more than a 24-hour window. However, we urge you to check with your management team for your company’s specific policies relating to this practice.

If the consumer does return after the specified time, politely inform them that you properly destroyed their card in order to protect their information and to ensure their security.

If you see anything you are uncertain about, report it

If something seems suspicious, report it. If you see credit cards being stored in an unsafe manner, report it to the proper management team so it may be corrected.

Additionally, regularly inspecting the cash wrap area for any evidence of physical hardware tampering is strongly recommended to combat security threats.